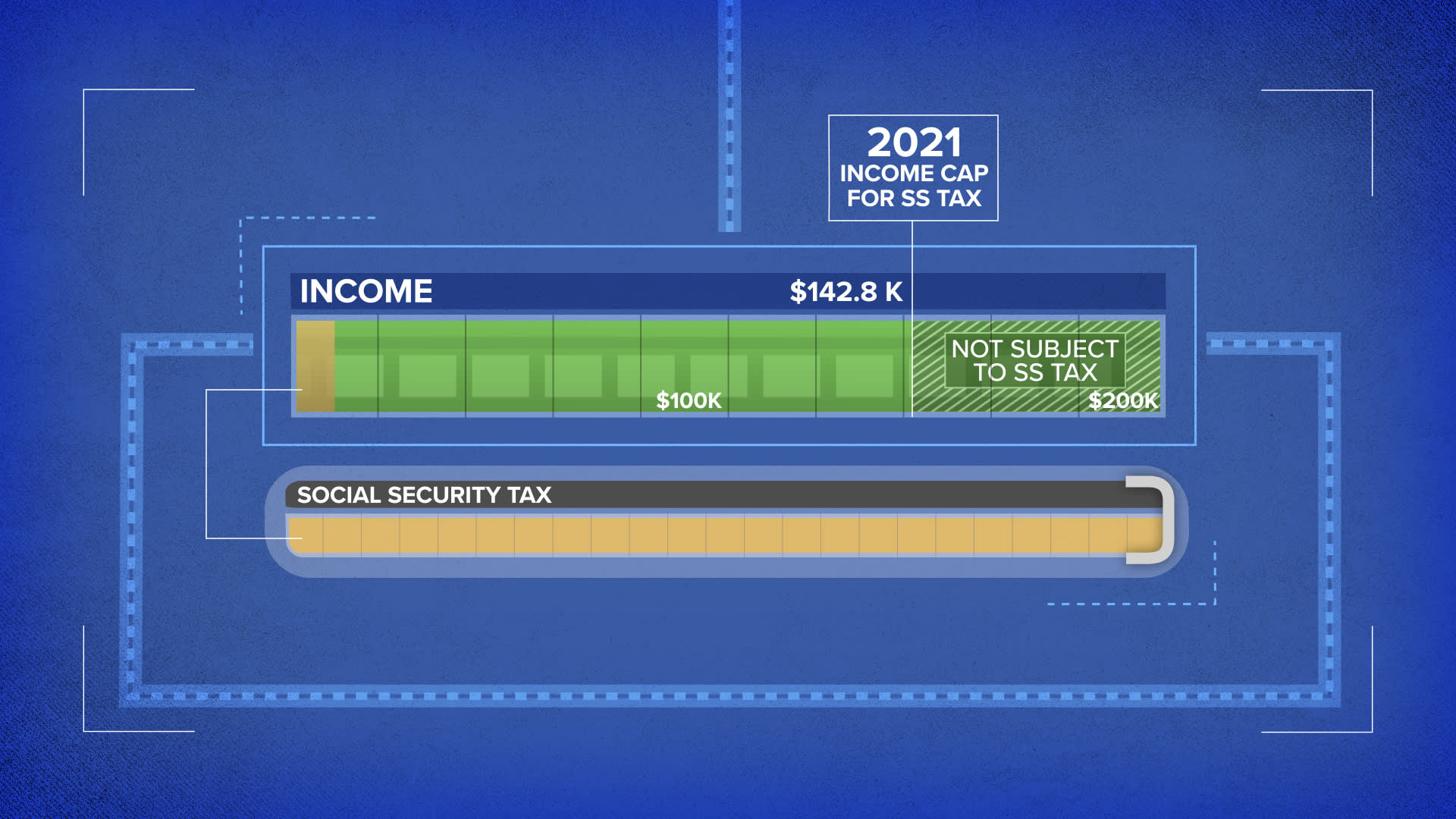

Social Security Earning Limit 2021 | Your employer would contribute an additional $8,853.20 per year. At one of my first speaking engagements, i heard a great story from one of the attendees. The most current version of this article uses numbers for 2021. Other important 2021 social security. As a result, in 2021 you'll pay no more than $8,853.60 ($142,800 x 6.2%) in social security taxes. If you are working, there is a limit on the amount of your earnings that is taxed by social security. Your employer would contribute an additional $8,853.20 per year. As a result, in 2021 you'll pay no more than $8,853.60 ($142,800 x 6.2%) in social security taxes. Previous social security colas have ranged from zero in 2010, 2011 and 2016 to 14.3% in 1980. The maximum earnings that are taxed has changed over the years as shown in the chart below. The maximum earnings that are taxed has changed over the years as shown in the chart below. The size of your benefit checks depends on your average indexed monthly. If you reach full retirement age in 2021, then you will be able to earn $50,520, up $1,920 from the 2020 annual limit of $48,600. At one of my first speaking engagements, i heard a great story from one of the attendees. In 2021, the limit is $18,950 for those reaching their full retirement age in 2022 or later. The social security earnings limit changes each year. Previous social security colas have ranged from zero in 2010, 2011 and 2016 to 14.3% in 1980. Other important 2021 social security. If you are working, there is a limit on the amount of your earnings that is taxed by social security. "if you are reaching full retirement age. Jan 02, 2021 · if you earn $142,800 per year in 2021, the maximum you'll pay in social security taxes is 6.2% of your income, or $8,853.60 per year. The most current version of this article uses numbers for 2021. Your employer would contribute an additional $8,853.20 per year. Oct 06, 2020 · retirement benefits. Previous social security colas have ranged from zero in 2010, 2011 and 2016 to 14.3% in 1980. Jan 02, 2021 · if you earn $142,800 per year in 2021, the maximum you'll pay in social security taxes is 6.2% of your income, or $8,853.60 per year. For every $3 you earn over the 2021 limit, your social security. Other important 2021 social security. If you reach full retirement age in 2021, then you will be able to earn $50,520, up $1,920 from the 2020 annual limit of $48,600. The social security earnings limit changes each year. Oct 14, 2020 · in 2021, this limit is $142,800, up from the 2020 limit of $137,700. Previous social security colas have ranged from zero in 2010, 2011 and 2016 to 14.3% in 1980. Your employer would contribute an additional $8,853.20 per year. Other important 2021 social security. Oct 06, 2020 · retirement benefits. For every $3 you earn over the 2021 limit, your social security. The maximum earnings that are taxed has changed over the years as shown in the chart below. May 10, 2021 · there's a different social security earnings limit for those who turn their full retirement age in 2021, and the penalty for earning too much is smaller. This amount is known as the maximum taxable earnings and changes each year. In 2021, the limit is $18,950 for those reaching their full retirement age in 2022 or later. in 2019, the annual earnings limit for those achieving full retirement age in 2020 or later was $17,640. The maximum earnings that are taxed has changed over the years as shown in the chart below. Jan 02, 2021 · if you earn $142,800 per year in 2021, the maximum you'll pay in social security taxes is 6.2% of your income, or $8,853.60 per year. If you reach full retirement age in 2021, then you will be able to earn $50,520, up $1,920 from the 2020 annual limit of $48,600. Social security retirement benefits are for workers 62 and older who have earned at least 40 credits. Other important 2021 social security. The maximum earnings that are taxed has changed over the years as shown in the chart below. Your employer would contribute an additional $8,853.20 per year. Nov 30, 2020 · in 2020, the annual social security earnings limit for those reaching full retirement age (fra) in 2021 or later is $18,240. If you are working, there is a limit on the amount of your earnings that is taxed by social security. Oct 14, 2020 · in 2021, this limit is $142,800, up from the 2020 limit of $137,700. For every $3 you earn over the 2021 limit, your social security. Other important 2021 social security. Previous social security colas have ranged from zero in 2010, 2011 and 2016 to 14.3% in 1980. May 10, 2021 · there's a different social security earnings limit for those who turn their full retirement age in 2021, and the penalty for earning too much is smaller. in 2019, the annual earnings limit for those achieving full retirement age in 2020 or later was $17,640. As a result, in 2021 you'll pay no more than $8,853.60 ($142,800 x 6.2%) in social security taxes. Jan 02, 2021 · if you earn $142,800 per year in 2021, the maximum you'll pay in social security taxes is 6.2% of your income, or $8,853.60 per year. In 2021, the limit is $18,950 for those reaching their full retirement age in 2022 or later.

:strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Social Security Earning Limit 2021: At one of my first speaking engagements, i heard a great story from one of the attendees.

0 comments:

Post a Comment